Financial Tools

Financial tools are available for use through Online Banking with Community West Bank. This feature allows you to budget and manage your finances by aggregating all of your accounts across multiple financial institutions so you can see balances and transactions all in one place, on any device. With Financial Tools, you no longer need to leave the safety and familiarity of Community West Bank's online banking system to monitor all of your accounts.

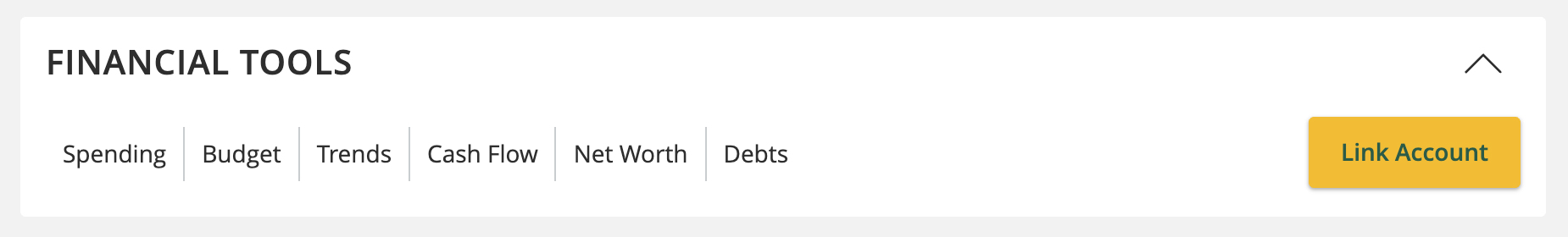

The Financial Tools feature allows you to view all of your accounts in one place so you can manage your spending and debts, calculate your net worth, and see spending trends over specific time periods. Several links appear at the top of the Home page, such as Net Worth and Budget. You can click those links to display visual representation of your financial data.

Available Tools:

- Spending – Enables you to see a visual representation of how you are spending your money over a period of time.

- Budget – Helps you set budgets for each spending category and track progress within those categories each month.

- Trends – Builds even further on your budgeting categories to help track spending over time as compared to income.

- Cash Flow – View all your income and expenses on a given day, including future predictions.

- Net Worth – Allows you to see the total value of all internally-held and linked accounts to view your net worth over time.

- Debts – Allows you to see all of your debt accounts in one place and to calculate how making additional payments, or paying off your debt completely, can impact your debt over time.

To take full advantage of these tools, you need to enroll in the Financial Tools feature within Online Banking. Financial Tools are available for Personal and Small Business Online Banking clients.

- After you have accessed your Community West Bank Online Banking Account, select the “Link account” button on the home page under Financial Tools, or click “Get Started” in the Link Account section under your account tiles.

- Read the Agreement, then click or tap Agree. Once you select agree, the Financial Tools feature on the Home page is enabled.

Linking accounts held at external financial institutions allows you to manage your finances by seeing balances and transactions all in one place, on any device. Link your credit cards, loans, checking, and savings accounts from other financial institutions one time. The Financial Tools feature updates data regularly so you always see accurate balances and recent transactions.

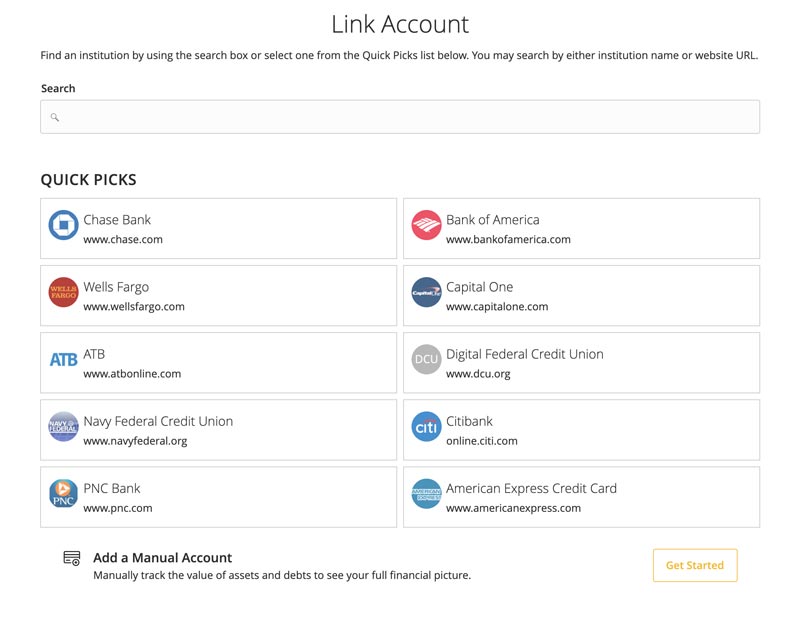

- On the Home page, click or tap the “Link Account” button under Financial Tools or click “Get Started” in the Link Account section under your account tiles.

- Select a Financial Institution from the list or type the name in the search box.

- Provide your online banking credentials for the external Financial Institution and click Continue. You may be required to provide additional information if the Financial Institution requires multi-factor authentication (MFA). Once completed, the Link Account page will display the status of the aggregation.

- When aggregation is complete, external accounts appear on the Link Account page, with the Hidden/Visible toggle set to Visible. Click or tap the Hidden/Visible toggle to hide an account on the Home page.

- Repeat steps 2-4 for each external account that you want to link to Financial Tools.

- Click Continue.

After you link accounts, they appear in a Linked Accounts group on the Home page, providing a full financial picture. You can reorder and group accounts, as necessary.