Consumer Terms and Conditions

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT

AGREEMENT

- summarize some laws that apply to common transactions;

- establish rules to cover transactions or events which the law does not regulate;

- establish rules for certain transactions or events which the law regulates but permits variation by agreement; and

- give you disclosures of some of our policies to which you may be entitled or in which you may be interested.

AMENDMENTS AND TERMINATION

CORRECTION OF CLERICAL ERRORS

NOTICES

ACCOUNT TRANSFER

TEMPORARY ACCOUNT AGREEMENT

FDIC INSURANCE

LIABILITY

DEPOSITS

VERIFICATION AND COLLECTION

WITHDRAWALS

UNDERSTANDING AND AVOIDING OVERDRAFT AND NONSUFFICIENT FUNDS (NSF) FEES

OWNERSHIP OF ACCOUNT AND BENEFICIARY DESIGNATION

accounts unless otherwise prohibited by law. We make no representations as to the appropriateness or effect of the ownership and beneficiary designations, except as they determine to whom we pay the account funds.. As used in this agreement “party” means a person who, by the terms of the account, has a present right, subject to request, to payment from a multiple party account other than as an agent.

manner affect the rights of owners or beneficiaries, if any, other than by withdrawing funds from the account. Owners are responsible for any transactions of the authorized signer. We undertake no obligation to monitor transactions to determine that they are on behalf of the owners.

If our policy allows for the designation of an authorized signer on an account with multiple owners (and without any multiple signatures requirement), then the following rules apply: Each owner individually authorizes the authorized signer to act on his/her behalf. Any one owner may revoke or terminate the authorization, and the authorized signer’s authority to access the account will continue only as long as no owner has revoked authorization. If no other event terminates the authority of the authorized signer, the authority is terminated upon the death of the last surviving owner.

POWER OF ATTORNEY

UTMA ACCOUNTS

FIDUCIARY ACCOUNTS

STOP PAYMENTS

TELEPHONE TRANSFERS

STATEMENTS

REIMBURSEMENT OF FEDERAL BENEFIT PAYMENTS

If we are required for any reason to reimburse the federal government for all or any portion of a benefit payment that was directly deposited into your account, you authorize us to deduct the amount of our liability to the federal government from the account or from any other account you have with us, without prior notice and at any time, except as prohibited by law. We may also use any other available legal remedy to recover the amount of our liability.SETOFF

RESTRICTIVE LEGENDS OR INDORSEMENTS

CHECK CASHING

INSTRUCTIONS FROM YOU

MONITORING AND RECORDING TELEPHONE CALLS AND ACCOUNT COMMUNICATIONS

If necessary, you may change or remove any of the telephone numbers, email addresses, or other methods of contacting you at any time using any reasonable means to notify us.

WAIVER OF NOTICES

ACH AND WIRE TRANSFERS

INTERNATIONAL ACH TRANSACTIONS

Financial institutions are required by law to scrutinize or verify any international ACH transaction (IAT) that they receive against the Specially Designated Nationals (SDN) list of the Office of Foreign Assets Control (OFAC). This action may, from time to time, cause us to temporarily suspend processing of an IAT and potentially affect the settlement and/or availability of such payments.INTERNATIONAL CONSUMER WIRE TRANSFERS

STALE-DATED CHECKS

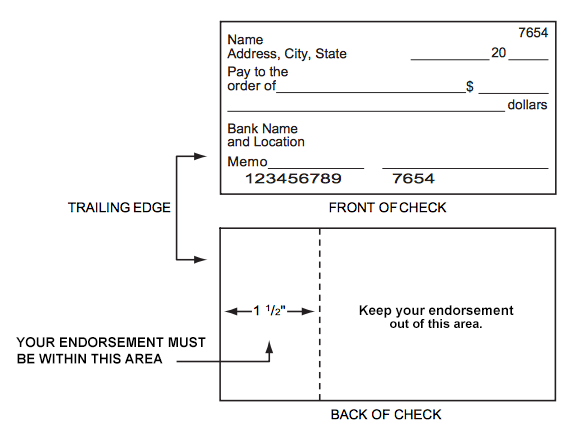

INDORSEMENTS

MOBILE DEPOSIT CAPTURE SERVICE

CHECK PROCESSING

CONVERTED CHECKS

CHECK STORAGE AND COPIES

UNCLAIMED PROPERTY

UNCLAIMED PROPERTY NOTICE

DEATH OR INCOMPETENCE

CASH TRANSACTION REPORTING

BACKUP WITHHOLDING/TIN CERTIFICATION

CREDIT VERIFICATION

LOST, DESTROYED, OR STOLEN CERTIFIED, CASHIER’S, OR TELLER’S CHECKS

CHANGING ACCOUNT PRODUCTS

TRANSACTIONS BY MAIL

LEGAL ACTIONS AFFECTING YOUR ACCOUNT

ACCOUNT SECURITY

It is your responsibility to protect the account numbers and electronic access devices (e.g., an ATM card) we provide you for your accounts. You should also safeguard your username, password, and other access and identifying information when accessing your account through a computer or other electronic, audio, or mobile device or technology. If you give anyone authority to access the account on your behalf, you should exercise caution and ensure the trustworthiness of that agent. Do not discuss, compare, or share information about your account numbers with anyone unless you are willing to give them full use of your money. An account number can be used by thieves to issue an electronic debit or to encode your number on a false demand draft which looks like and functions like an authorized check. If you furnish your access device or information and grant actual authority to make transfers to another person (a family member or coworker, for example) who then exceeds that authority, you

are liable for the transfers unless we have been notified that transfers by that person are no longer authorized. Your account number can also be used to electronically remove money from your account, and payment can be made from your account even though you did not contact us directly and order the payment.

You must also take precaution in safeguarding your blank checks. Notify us at once if you believe your checks have been lost or stolen. As between you and us, if you are negligent in safeguarding your checks, you must bear the loss entirely yourself or share the loss with us (we may have to share some of the loss if we failed to use ordinary care and if we substantially contributed to the loss).

CLAIM OF LOSS

EARLY WITHDRAWAL PENALTIES (and involuntary withdrawals)

CHANGES IN NAME AND CONTACT INFORMATION

RESOLVING ACCOUNT DISPUTES

CHECKING ACCOUNTS

ZERO BALANCE

NOTICE OF NEGATIVE INFORMATION

ELECTRONIC FUND TRANSFERS YOUR RIGHTS AND RESPONSIBILITIES

- Preauthorized credits. You may make arrangements for certain direct deposits to be accepted into your checking or savings account(s).

- Preauthorized payments. You may make arrangements to pay certain recurring bills from your checking, savings, or money market account(s).

- Electronic check conversion. You may authorize a merchant or other payee to make a one-time electronic payment from your checking account using information from your check to pay for purchases or pay bills.

- Electronic returned check charge. You may authorize a merchant or other payee to initiate an electronic funds transfer to collect a charge in the event a check is returned for insufficient funds.

- transfer funds from checking to checking

- transfer funds from checking to savings

- transfer funds from savings to checking

- transfer funds from savings to savings

- make a payment from checking or savings to your loan with us

- get information about:

- the account balance of checking account(s)

- the account balance of savings account(s)

- make deposits to checking account(s)

- make deposits to savings account(s

- get cash withdrawals of no more than $500.00 from your checking and/or savings account(s) per card per day*

- transfer funds from savings to checking account(s)

- transfer funds from checking to savings account(s)

- get information about:

- the account balance of your checking account(s)

- the account balance of your savings account(s)

- you may not exceed the maximum daily limit established by the Bank in transactions per card per day in goods and services (if there are sufficient funds available), exclusive of ATM transactions*. When making larger purchases that are over your VISA® Debit Card daily limit, please plan for an alternative method of payment.

VISA® Debit Card (Transaction Limits Using Your Signature)

Non-Visa Debit Transaction Processing

- signing a receipt

- providing a card number over the phone or via the Internet

- swiping your card through a point-of-sale terminal

- entering a PIN at a point-of-sale terminal

- initiating a payment directly with the biller (possibly via telephone, internet, or kiosk location) by providing an account number or other information that is not your PIN to authorize the transaction after clearly indicating a preference to route it as a non-Visa transaction

- transfer funds from checking to checking

- transfer funds from checking to savings

- transfer funds from savings to checking

- transfer funds from savings to savings

- transfer funds from your line of credit (your line must have availability and be in good standing)

- make payments from checking to third parties (Bill Payment)

- Please refer to our separate Schedule of Fees

- get information about:

- the outstanding balance of loans(s)

- the account balance of checking account(s)

- the account balance of savings account(s)

- the account history of checking and savings

- the account balance of Certificate of Deposit account(s)

- check account balances

- make a deposit

- transfer funds between your checking and savings accounts

- pay bills

- view transaction history

- make a loan payment

- find nearby ATMs or branch locations

Text Banking

- check account balances

- find nearby ATMs or branch locations

- view transaction history

Mobile Deposit Capture

FEES

- We do not charge for direct deposits to any type of account.

- We do not charge for preauthorized payments from any type of account.

- We will charge a replacement card fee. Please refer to our separate Schedule of Fees.

DOCUMENTATION

- Terminal transfers. You can get a receipt at the time you make a transfer to or from your account using an automated teller machine or point-of-sale terminal. However, you may not get a receipt if the amount of the transfer is $15 or less.

- Preauthorized credits. If you have arranged to have direct deposits made to your account at least once every 60 days from the same person or company, you can call us at 800-298-1775 to find out whether or not the deposit has been made.

- Periodic statements.

You will get a monthly account statement from us for your checking accounts or savings accounts (if linked).

You will get a monthly account statement from us for your savings accounts, unless there are no transfers in a particular month. In any case, you will get a statement at least quarterly.

PREAUTHORIZED PAYMENTS

- Right to stop payment and procedure for doing so. If you have told us in advance to make regular payments out of your account, you can stop any of these payments. Here is how:

Call or write us at the telephone number or address listed in this disclosure in time for us to receive your request 3 business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within 14 days after you call.

Please refer to our separate Schedule of Fees for the amount we will charge you for each stop-payment order you give.

NOTE: You may not stop payment on an ATM, point-of-sale, or VISA® Debit Card transaction. - Notice of varying amounts. If these regular payments may vary in amount, the person you are going to pay will tell you, 10 days before each payment, when it will be made and how much it will be. (You may choose instead to get this notice only when the payment would differ by more than a certain amount from the previous payment, or when the amount would fall outside certain limits that you set.)

- Liability for failure to stop payment of preauthorized transfer. If you order us to stop one of these payments 3 business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

FINANCIAL INSTITUTION’S LIABILITY

- If, through no fault of ours, you do not have enough money in your account to make the transfer.

- If you have an overdraft line and the transfer would go over the credit limit.

- If the automated teller machine where you are making the transfer does not have enough cash.

- If the terminal or system was not working properly and you knew about the breakdown when you started the transfer.

- If circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

- There may be other exceptions stated in our agreement with you.

CONFIDENTIALITY

- where it is necessary for completing transfers; or

- in order to verify the existence and condition of your account for a third party, such as a credit bureau or merchant; or

- in order to comply with government agency or court orders; or

- as explained in the separate Privacy Disclosure; or

- if you give us written permission.

UNAUTHORIZED TRANSFERS

- (a) Consumer liability.

- Generally. Tell us AT ONCE if you believe your card and/or code has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit). You can lose no more than $50 if someone used your card and/or code without your permission, and, either:

- your card can be used to initiate a transaction without a PIN or other personal identification number, or

- you tell us within 2 business days after you learn of the loss or theft of your card and/or code. If you do NOT tell us within 2 business days after you learn of the loss or theft of your card and/or code, and we can prove we could have stopped someone from using your card and/or code without your permission if you had told us, you could lose as much as $500.

- Also, if your statement shows transfers that you did not make, including those made by card, code or other means, tell us at once. If you do not tell us within 60 days after the statement was mailed to you, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us in time. If a good reason (such as a long trip or a hospital stay) kept you from telling us, we will extend the time periods.

- Additional Limit on Liability for VISA® Debit Card. Unless you have been negligent or have engaged in fraud, you will not be liable for any unauthorized transactions using your lost or stolen VISA® Debit Card. This additional limit on liability does not apply to ATM transactions outside of the U.S., to ATM transactions not sent over VISA® or Plus networks, or to transactions using your Personal Identification Number which are not processed by VISA®. Visa is a registered trademark of Visa International Service Association.

- Generally. Tell us AT ONCE if you believe your card and/or code has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit). You can lose no more than $50 if someone used your card and/or code without your permission, and, either:

- (b) Contact in event of unauthorized transfer. If you believe your card and/or code has been lost or stolen, call or write us at the telephone number or address listed in this disclosure. You should also call the number or write to the address listed in this disclosure if you believe a transfer has been made using the information from your check without your permission.

ERROR RESOLUTION NOTICE

- Tell us your name and account number (if any).

- Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

- Tell us the dollar amount of the suspected error.

NOTICE OF ATM/NIGHT DEPOSIT FACILITY USER PRECAUTIONS

- Prepare for your transactions at home (for instance, by filling out a deposit slip) to minimize your time at the ATM or might deposit facility.

- Mark each transaction in your account record, but not while at the ATM or night deposit facility. Always save your ATM receipts. Don’t leave them at the ATM or night deposit facility because they may contain important account information.

- Compare your records with the account statements you receive.

- Don’t lend your ATM card to anyone.

- Remember, do not leave your card at the ATM. Do not leave any documents at a night deposit facility.

- Protect the secrecy of your Personal Identification Number (PIN). Protect your ATM card as though it were cash. Don’t tell anyone your PIN. Don’t give anyone information regarding your ATM card or PIN over the telephone. Never enter your PIN in any ATM that does not look genuine, has been modified, has a suspicious device attached, or is operating in a suspicious manner. Don’t write your PIN where it can be discovered. For example, don’t keep a note of your PIN in your wallet or purse.

- Prevent others from seeing you enter your PIN by using your body to shield their view.

- If you lose your ATM card or if it is stolen, promptly notify us. You should consult the other disclosures you have received about electronic fund transfers for additional information about what to do if your card is lost or stolen.

- When you make a transaction, be aware of your surroundings. Look out for suspicious activity near the ATM or night deposit facility, particularly if it is after sunset. At night, be sure that the facility (including the parking area and walkways) is well lighted. Consider having someone accompany you when you use the facility, especially after sunset. If you observe any problem, go to another ATM or night deposit facility.

- Don’t accept assistance from anyone you don’t know when using an ATM or night deposit facility.

- If you notice anything suspicious or if any other problem arises after you have begun an ATM transaction, you may want to cancel the transaction, pocket your card and leave. You might consider using another ATM or coming back later.

- Don’t display your cash; pocket it as soon as the ATM transaction is completed and count the cash later when you are in the safety of your own car, home, or other secure surrounding.

- At a drive-up facility, make sure all the car doors are locked and all of the windows are rolled up, except the driver’s window. Keep the engine running and remain alert to your surroundings.

- We want the ATM and night deposit facility to be safe and convenient for you. Therefore, please tell us if you know of any problem with a facility. For instance, let us know if a light is not working or there is any damage to a facility. Please report any suspicious activity or crimes to both the operator of the facility and the local law enforcement officials immediately.

YOUR ABILITY TO WITHDRAW FUNDS

LONGER DELAYS MAY APPLY

SPECIAL RULES FOR NEW ACCOUNTS

DEPOSITS AT AUTOMATED TELLER MACHINES

SUBSTITUTE CHECKS AND YOUR RIGHTS

- A description of why you have suffered a loss (for example, you think the amount withdrawn was incorrect);

- An estimate of the amount of your loss;

- An explanation of why the substitute check you received is insufficient to confirm that you suffered a loss; and

- A copy of the substitute check or the following information to help us identify the substitute check: the check number, the amount of the check, the date of the check, the name of the person to whom you wrote the check, and signer on the check.

TRUTH-IN-SAVINGS DISCLOSURE

STUDENT CHECKING ACCOUNT

- Canceled Checks - This is a “truncated-checking” account. This means that your canceled checks and or image checks will not be returned to you. You will receive a monthly statement listing transactions on your account.

- Copies of Image Checks - Upon your request (accountholder) the bank will provide two (2) free copies of image checks per monthly statement cycle at no charge. Thereafter copies in excess of two (2) can be reproduced at the current cost of research and per copy fees. Please refer to our separate Schedule of Fees.

SIMPLICITY CHECKING ACCOUNT

- Per Item Fees - $1.00 charge per check/draft after five (5) per monthly statement cycle. If you use our Online Banking Bill Payment Service, you may experience circumstances where the vendor might issue a check rather than an electronic debit. You may be charged a fee if the item exceeds the allowable number of checks/drafts per monthly statement cycle.

- Canceled Checks - This is a “truncated-checking” account. This means that your canceled checks and or image checks will not be returned to you. You will receive monthly electronic statements listing transactions on your account.

- Copies of Image Checks - Upon your request (accountholder) the bank will provide two (2) free copies of image checks per monthly statement cycle at no charge. Thereafter copies in excess of two (2) can be reproduced at the current cost of research and per copy fees. Please refer to our separate Schedule of Fees.

SECURE CHECKING ACCOUNT

- Per Item Fees - $1.00 charge per check/draft after fifteen (15) per monthly statement cycle. If you use our Online Banking Bill Payment Service, you may experience circumstances where the vendor might issue a check rather than an electronic debit. You may be charged a fee if the item exceeds the allowable number of checks/drafts per monthly statement cycle.

- Canceled Checks - This is a “truncated-checking” account. This means that your canceled checks and or image checks will not be returned to you. You will receive monthly statements listing transactions on your account.

- Copies of Image Checks - Upon your request (accountholder) the bank will provide two (2) free copies of image checks per monthly statement cycle at no charge. Thereafter copies in excess of two (2) can be reproduced at the current cost of research and per copy fees. Please refer to our separate Schedule of Fees.

RELATIONSHIP INTEREST CHECKING

CUTMA SAVINGS ACCOUNT

MONEY MARKET ACCOUNT

PREMIUM MONEY MARKET ACCOUNT

REGULAR SAVINGS ACCOUNT

MINOR SAVINGS ACCOUNT

RATES AND ANNUAL PERCENTAGE YIELDS

TIME CERTIFICATE OF DEPOSIT

Refer to your Certificate of Deposit or IRA Custodial Booklet for complete details.

- Certificate of Deposit accounts: Interest will not be compounded. Interest will be credited to your account every quarter or at maturity.

- Individual Retirement Certificate of Deposit accounts: Interest is compounded daily and credited every quarter or at maturity.

- You may not make any deposits into your account before maturity.

- You cannot make withdrawals of principal from your account before maturity without our consent. Principal withdrawn before maturity is included in the amount subject to early withdrawal penalty.

- You can only withdraw interest credited in the term before maturity of that term without penalty. You can withdraw interest any time after crediting to the account during the current term.

- If your account has an original maturity of 6 months or less:

The fee we may impose will equal 90 days interest on the amount withdrawn subject to penalty. - If your account has an original maturity of 12 months:

The fee we may impose will equal 180 days interest on the amount withdrawn subject to penalty. - If your account has an original maturity of 18 months:

The fee we may impose will equal 270 days interest on the amount withdrawn subject to penalty. - If your account has an original maturity of 24 months:

The fee we may impose will equal 365 days interest on the amount withdrawn subject to penalty. - If your account has an original maturity of 36 months:

The fee we may impose will equal 545 days interest on the amount withdrawn subject to penalty. - If your account has an original maturity of 60 months:

The fee we may impose will equal 910 days interest on the amount withdrawn subject to penalty.

IRA SAVINGS ACCOUNT

Refer to your Certificate of Deposit or IRA Custodial Booklet for complete details.

Minimum balance to obtain the annual percentage yield disclosed - You must maintain a minimum balance of $25.00 (IRA Savings) or $100.00 (Traditional or Coverdell IRA Savings) in the account each day to obtain the disclosed annual percentage yield.

HEALTH SAVINGS ACCOUNT

NON-SUFFICIENT FUNDS BALANCE

- The payment of checks, electronic funds transfers or other in-person withdrawal requests;

- Payments authorized by you, including ACH debits;

- The return of unpaid items deposited by you;

- The imposition of bank service charges;

- The deposit of items which according to the Bank’s Funds Availability Policy, are treated as not yet “available” or finally paid; i.e. “Holds placed on items you deposit”

- ATM withdrawals or other electronic means as applicable.